08 Mar Part 1 | Anticipated Construction & Human Capital Management Trends for 2023

It is undeniable that post-pandemic has brought about a number of challenges with hiring and managing top talent throughout 2022 & 2023 – and with the ongoing skill shortage globally, it is now more important than ever that employers pivot their proposition to attract highly skilled workers.

There is no doubt that talent attraction and retention are some of the top-of-mind concerns plaguing employers and HR teams today. After all, employees’ priorities are shifting – not only are they re-evaluating the importance of job security and business ethics, but they are also gaining higher expectations about job satisfaction and outlook.

Part 1 is a very brief summary of the outlook and trends on the construction industry, while Part 2 will dive deeper on the Human Capital Management trends of 2023!

Sydney Build Expo 2023

The team at Welink. Recruitment were fortunate to attend the Sydney Build Expo and had the opportunity to listen to industry leaders; David Alessi (Senior Project Manager), Alberto Sanchez (Head of Planning) & Dr Nathan Kirchner (Special Advisor) discuss about construction trends and outlook.

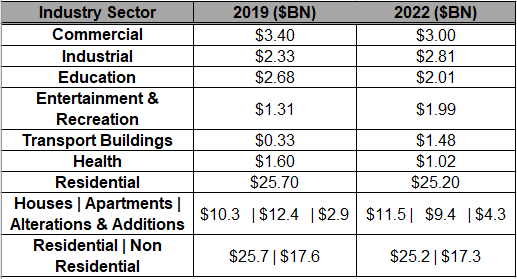

The below data was provided by David Alessi regarding construction spend ($BN) broken down to its individual industries pre and post pandemic;

Based on the data provided, some interesting trends such as;

1. Residential construction remains to be the biggest contributor to the NSW economy. However, the market have reduced their demand for apartments and instead, opted for housing to accommodate to the demand for space post pandemic.

2. Increase demand for industrial warehouses to meet the demand for personal storage spaces post pandemic.

3. NSW Government pivoting to the demands of increasing construction for entertainment and recreational works

4. Increase in construction of Transport Buildings to further enhance accessibility and house new workforce operating new transport infrastructure.

Further to this data, Troy Chapman (Commercial Director), Charly Bai An Chen (Senior Commercial Analyst) discussed about the difficulty of borrowing being a contributor for the reduced amount of DA application, therefore, we may see a slight halt on residential construction sector in Sydney. However, there seems to be a trend of Sydney Siders exploring options of relocating to regional areas which may indicate opportunities for the housing sectors in these areas.

Despite the construction industry not having returned to pre-pandemic levels, the world of work seems to be busy as ever and the market to compete for top talent will remain as the key challenge to preventing the world of work to move forward.

So how should companies pivot to attract top talent and address the skill shortage issue? Stay tuned for part 2!

Sorry, the comment form is closed at this time.